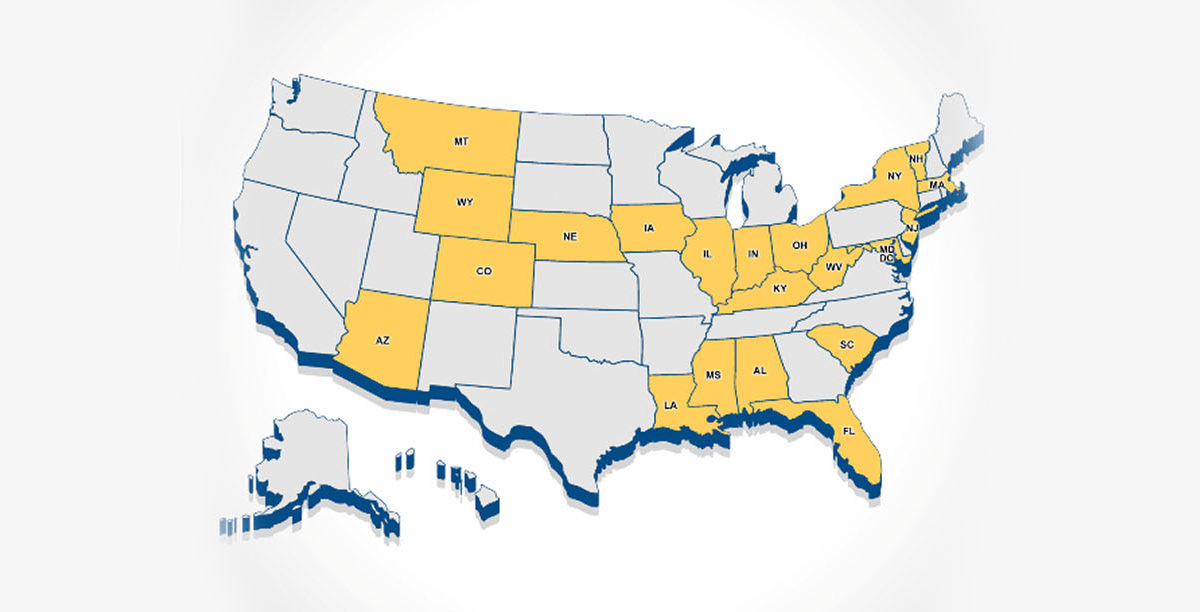

Currently, tax lien certificates are offered in about half the states in the United States, the remaining half offer what are known as tax deeds. Both tax lien certificates and tax deeds are a way for local governments to recover lost property tax revenue to fund public school, police departments, fire departments, libraries. and public roads. For educated investors, both can offer a very profitable investment opportunity.

How to Benefit from Tax Lien Certificate Overages

Property investors are in for a treat on tax lien certificateoverages. If you have not heard of this yet, then this is the time to know what it is. Tax lien certificate overages are created by tax sales which are running wild with the current foreclosure rates today. With these overages alone you can potentially create a large income. Also, you can do this on your home office.

Safe and Profitable Tax Lien Certificates

If you know someone who participates in tax lien auctions, they would tell you that taxes can be a very profitable investment to make. A whole new business has opened up because of the fact that there are many people out there that researches local auctions for sale on real estate for delinquent property taxes.

Why Would You Want a Tax Lien Certificate?

Tax lien certificates present you with an outstanding package of benefits.

HIGH YIELD

The main attraction of tax lien certificates is their consistently high yield.