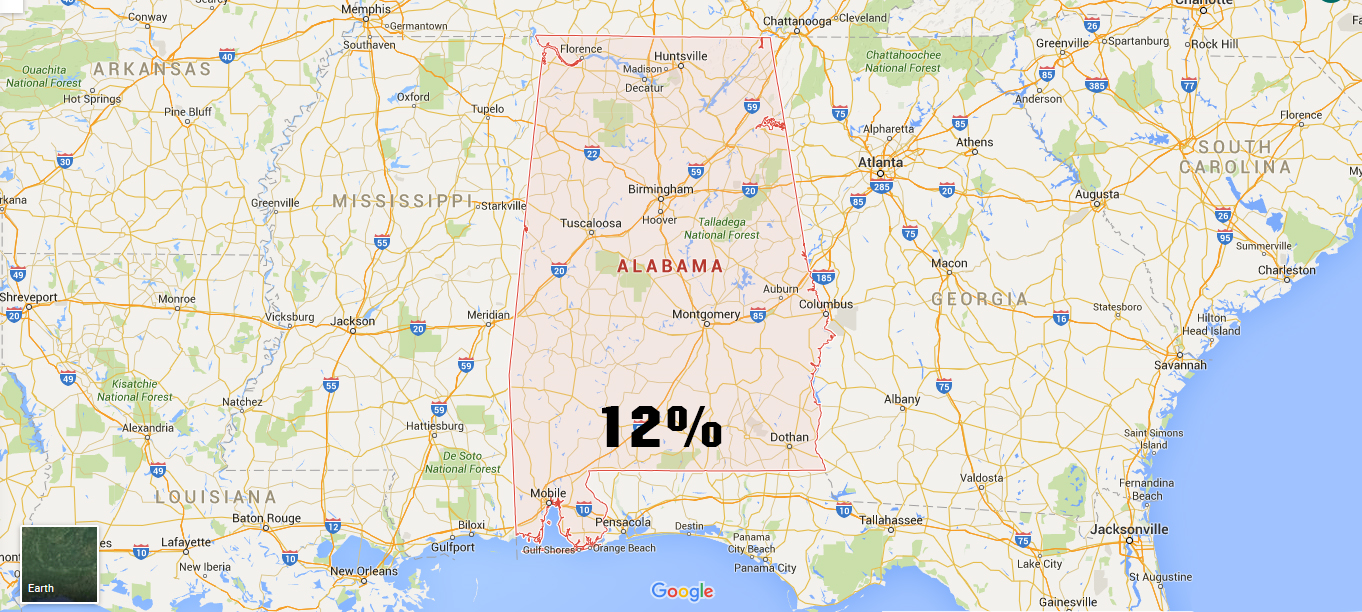

Tax Lien sales are being conducted in May in Alabama every year. The interest rate in Alabama is 12% and the redemption period is 3 years.

This state also conducts tax foreclosure sales and if the tax lien certificate is still not redeemed after 3 years, it will then become a tax deed. The bidding process of tax lien sales involves competitive bidding.

In Arizona, the interest rate is 16% while the redemption period is 3 years. Tax Lien sales are usually held in May or June but still may depend on the specific county. Auctions in this state are by competitive bidding.

Aside from having a 16% interest rate, most counties in Arizona have full parcels of land that are on sale for the whole year. You can get listings of these available parcels after the tax lien auctions in printouts or discs for $50 at the Client Services Department at the Treasurer’s Office.

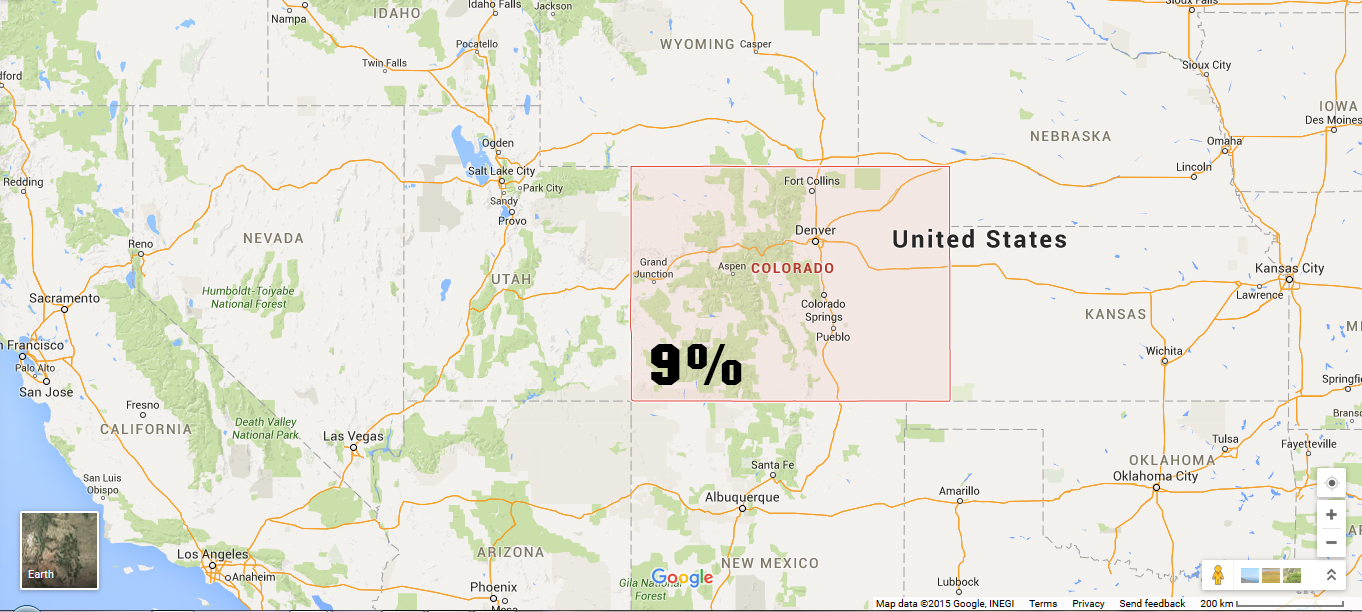

Colorado’s interest rate is 9% plus with federal discount rate with a three year redemption period. Since the interest rate may get a bid down, it is advisable to be cautious when bidding in popular counties.

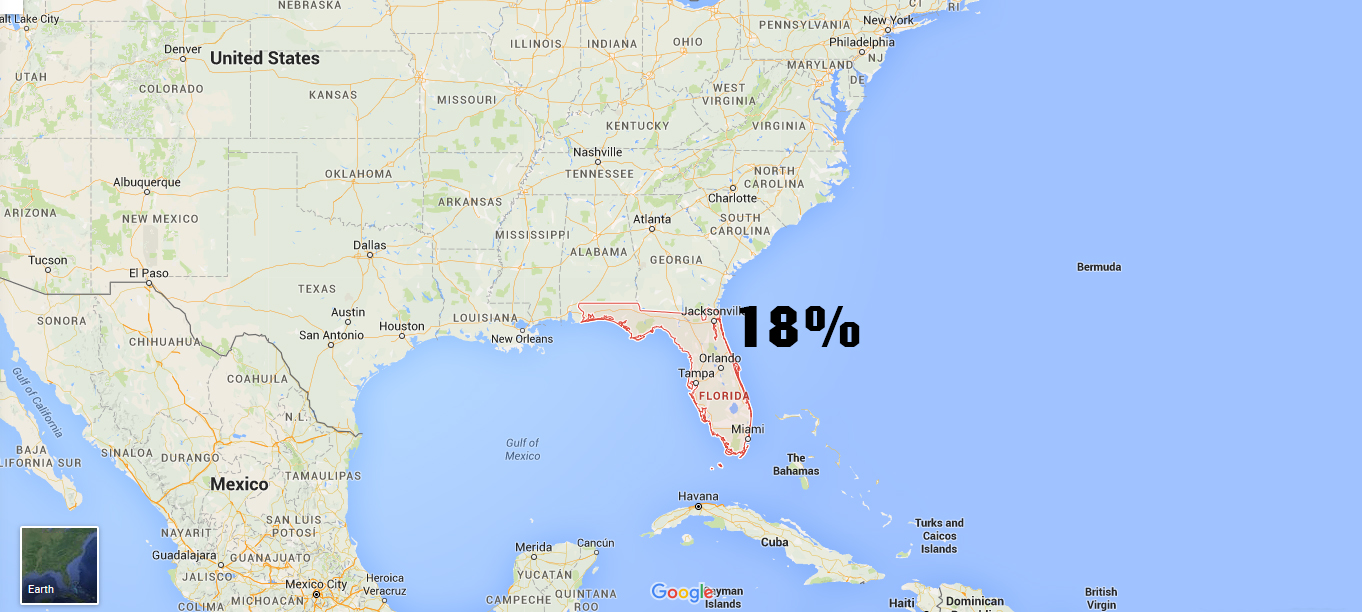

Take note, Florida is both a tax deed and tax lien state. The interest rate here is 18% and its redemption period is 2 years. Tax lien sales are held in May and June and one may win an auction through competitive bidding.

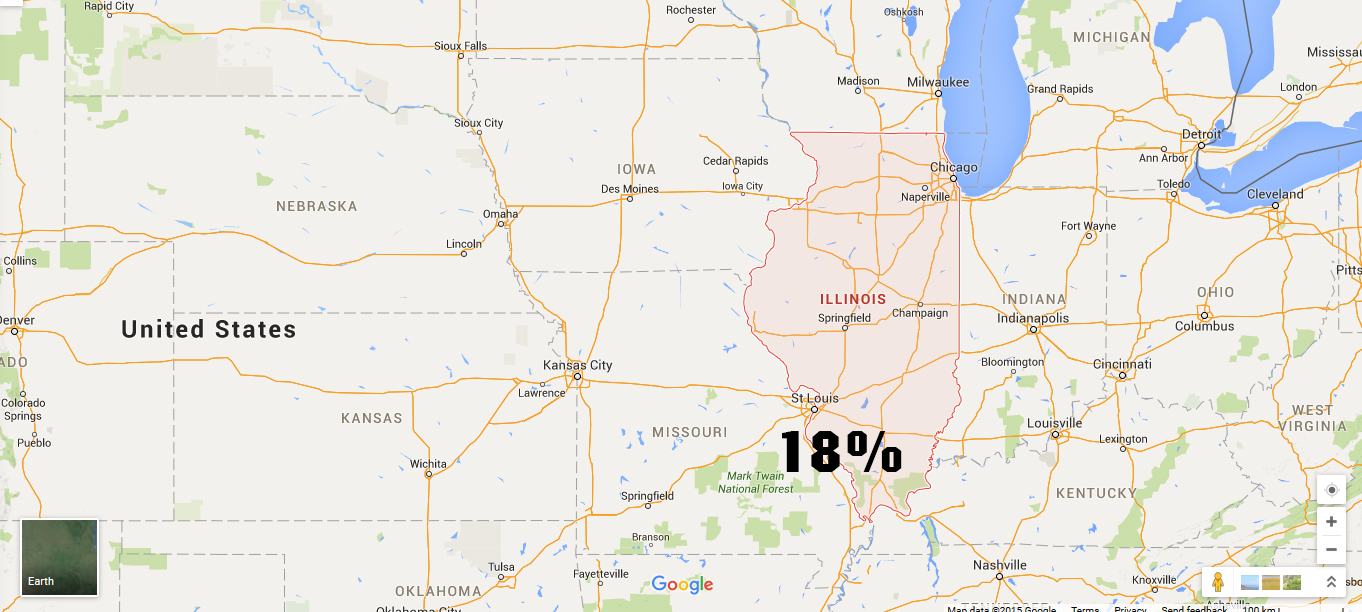

Illinois’ interest rate is 24% on farm land and 36% for a full year. County tax sales in Illinois are held in November and the redemption period is 2 years.

Most counties require the bidder to pre-register at least 10 days ahead of the auction schedule.

Indiana is one of the preferred states to invest in real estate. Aside from the fact that the interest rate is favorable and flat free, the redemption period is short unlike others.

The interest rate can be as high as 25% and 10% flat for the first 6 months. The second 6 months can then be 15% and an overbid interest of 10% every year. The redemption period is just 1 year for A and B properties while 120 days for the C properties. There is no right of redemption after sales. Tax lien sales are held in August, September, and in October.

One of the most popular tax lien states is Iowa. Its interest rate per year is 24% and its redemption period is 1.75 years. The tax lien sales are held in June and all its auctions are through round robin bidding. The bidder can also opt to bid on how much percentage he can take on the property.

The interest rate in Kentucky is 12% while the redemption period is 1 year. The tax lien sale schedules may vary depending on the county itself but all the sales are won by competitive bidding on the interest rate.

Louisiana is considered one of the best states to invest in tax lien certificates. Its interest rate is 12% plus a penalty of 5% which totals into 17%. The redemption period is 3 years and the tax lien auctions are dependent on Parish. The sales are through competitive bidding based on interest rate.

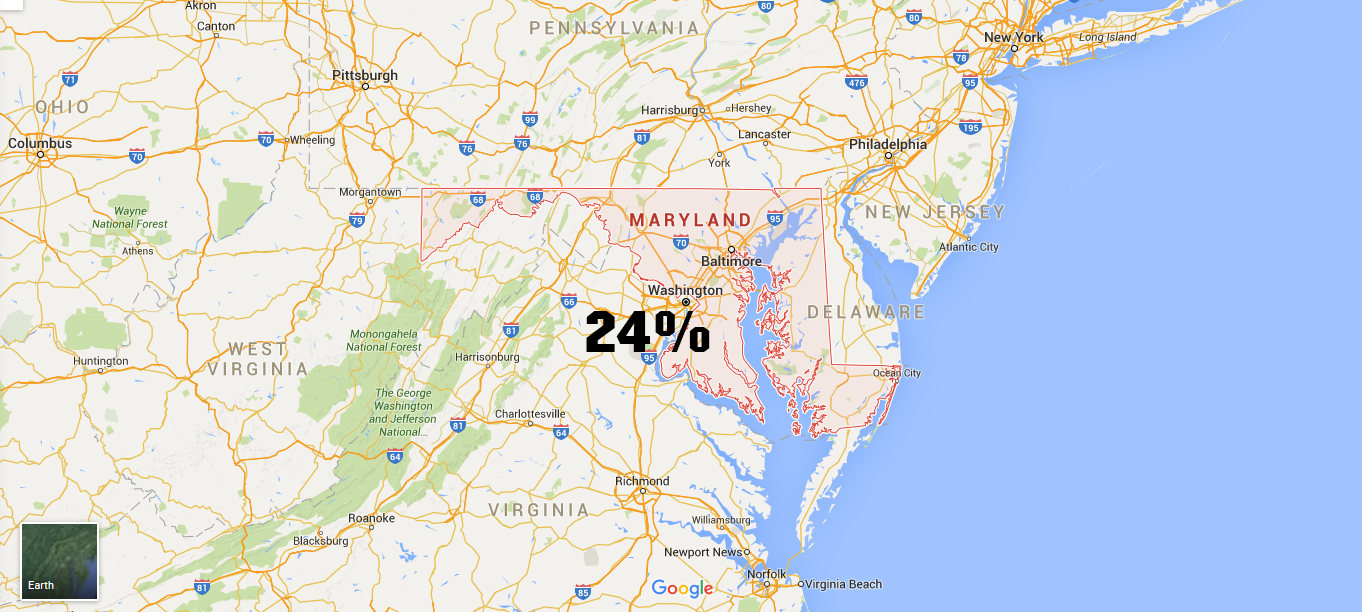

Maryland has an interest rate of 6% to 24% and varies on each county. The redemption period could be 6 months up to 2 years as each of the counties have varied rules. Competitive bidding is also used in tax lien certificate auctions.