Wisconsin now only offers tax deed sales which are controlled by municipalities. These sales are held in September and follows competitive bidding.

Washington Tax Deeds

Washington conducts tax deed sales only so no tax lien auctions are being held. The deed sales are by competitive bidding but the rules and processes are dependent on each county.

Virginia Tax Deeds

Virginia only holds tax deed sales which are done by competitive bidding. Sales are also conducted at most 4 times in a year. There is no minimum bid in Virginia.

Utah Tax Deeds

Utah only does tax deed certificates sales and these sales are held in May. Auctions are done by competitive bidding but counties have a lot of options in selling properties that face tax foreclosures.

Texas Tax Deeds

Texas is considered the best tax deed state because aside from having 25% interest rate for the first 6 months on tax deed properties that will be redeemed by the owner, it also contains a lot of available properties.

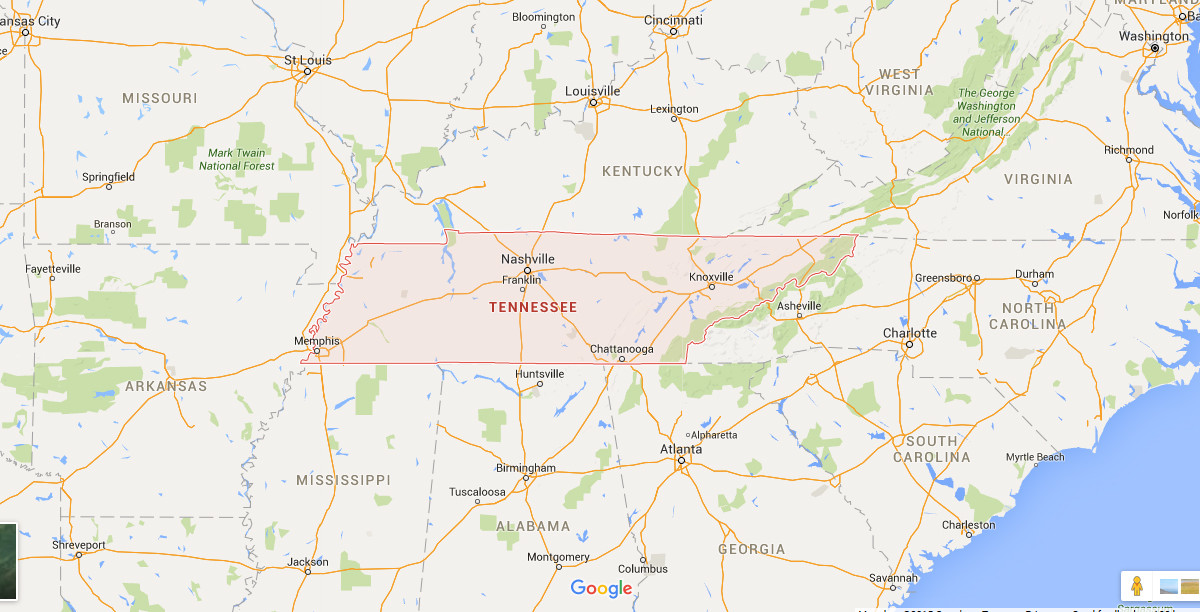

Tennessee Tax Deeds

Tennessee has a 1 year right of redemption with 10% fee. It only conducts tax deed certificate sales through competitive bidding. The Master of the Chancery Court and Clerk conduct these tax deed sales. The opening bid will be the taxes owed plus the penalty and the court costs.

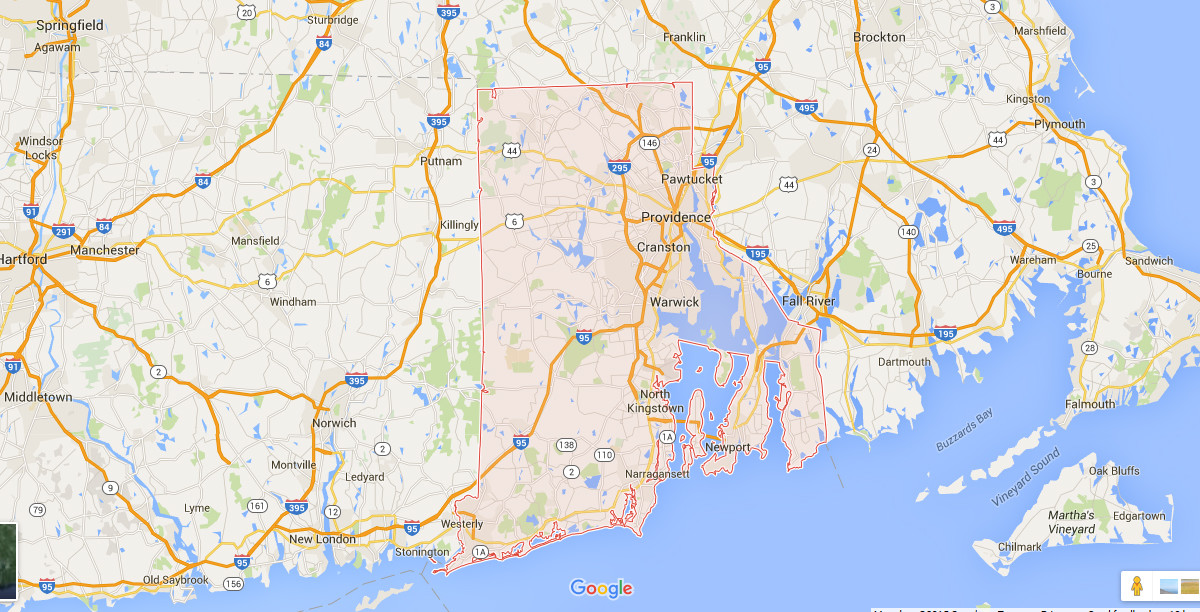

Rhode Island Tax Deeds

Though Rhode Island does not conduct tax lien sales, it holds tax deed certificate sales with 16% interest rate right of redemption. The auctions are done by competitive bidding and buyers may bid partial ownership.

Pennsylvania Tax Deeds

Pennsylvania only conducts tax deed certificate sales. In most counties, there will be no right of redemption after the sales except for Philadelphia wherein it may apply if the property was occupied by the owner 90 days before the sale. Most sales occur in September while the Judicial Sales occur in spring.

Oregon Tax Deeds

Oregon only has tax deed sales wherein there is no redemption period or no interest rate. The tax deed certificate sale schedules vary. These sales are usually done by competitive bidding and its minimum bid is set at 80% of its assessed value.

Oklahoma Tax Deeds

Oklahoma only conducts tax deed sales which are usually offered in the month of June. The minimum begins at the taxes that are being owed.