Since Arkansas only conducts tax deed certificate sales, it does not have an interest rate. The redemption period is actually 4 years but owners can also contest the sale to have an additional 2 years. Just like the others, tax deed sales are through competitive bidding.

Alaska Tax Deeds

Alaska has no interest rate as it only holds tax deed sales or tax foreclosure sales. The redemption period depends on Borough (County) rules. All of the tax deed sales are done by competitive bidding.

West Virginia Tax Liens

he interest rate in West Virginia is 12% but there will be no interest received on an overbid. The redemption period is 17 months. Tax lien certificate sales are in October and November in some counties and follow competitive bidding.

Wyoming Tax Liens

In Wyoming, the redemption period is 4 years with an 18% interest rate. Most tax lien certificate sales in majority of its counties are held in July through October. The tax lien auctions are done through competitive bidding.

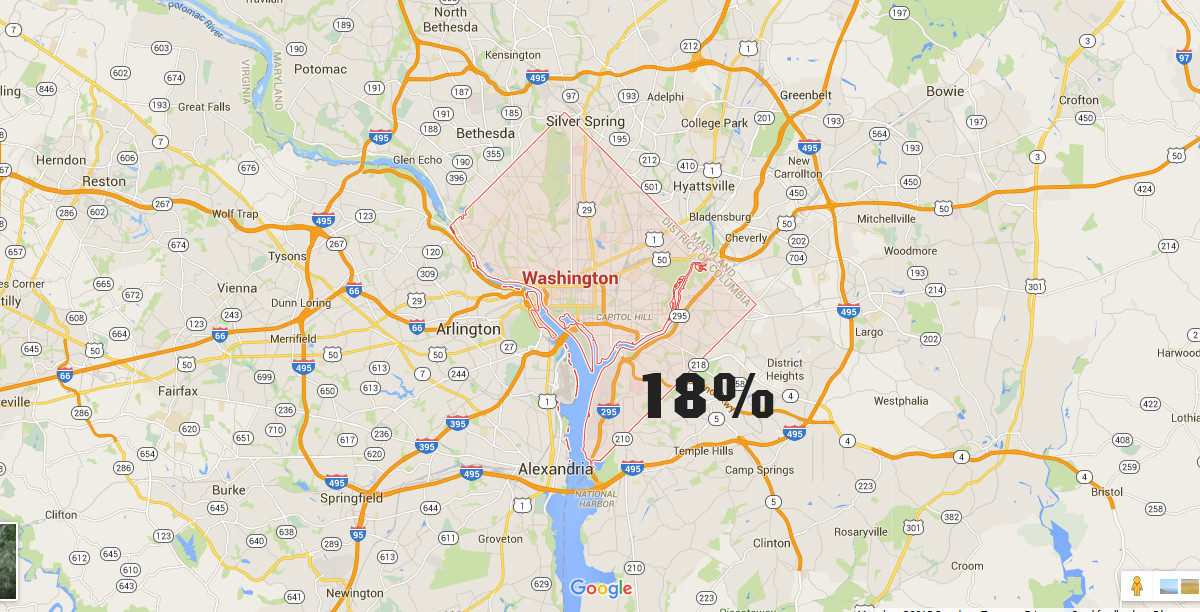

Washington DC Tax Liens

Both handling tax lien and tax deed sales, Washington DC has an 18% interest rate per year (1½ % per month) with a redemption period of 6 months. All tax lien sales are by competitive bidding but with no interest on an overbid.

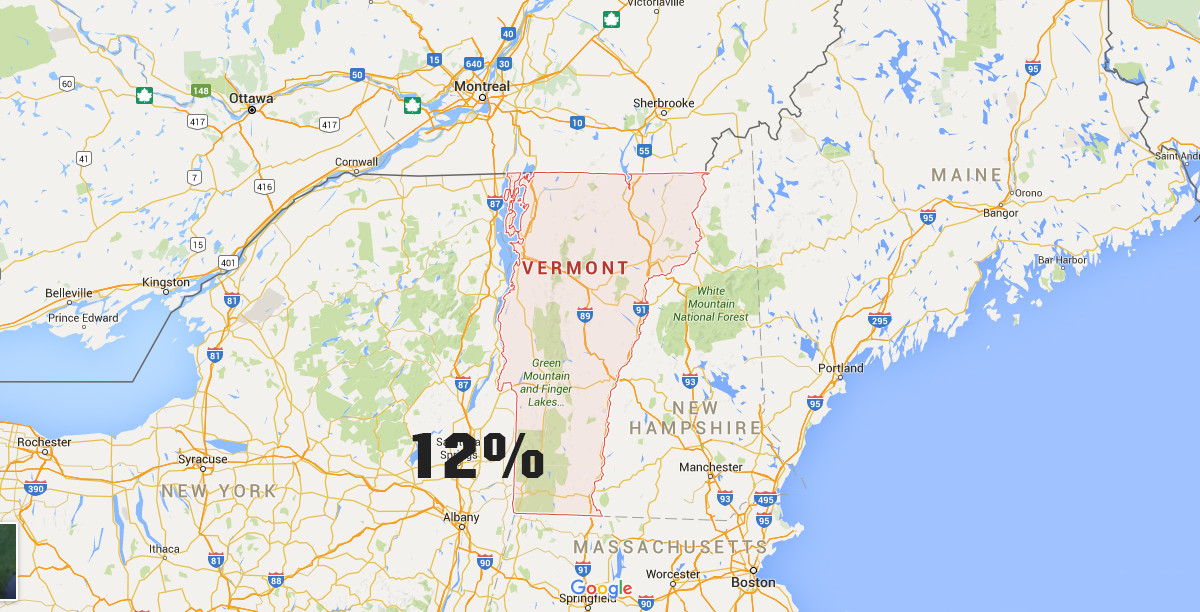

Vermont Tax Liens

Vermont has an interest rate of 12% and a redemption period of 1 year. All of its tax lien certificate auctions are done by competitive bidding.

South Dakota Tax Liens

As of 2006, South Dakota does not conduct Tax Lien or Tax Deed Auctions. However, foreclosure sales are held at state level.

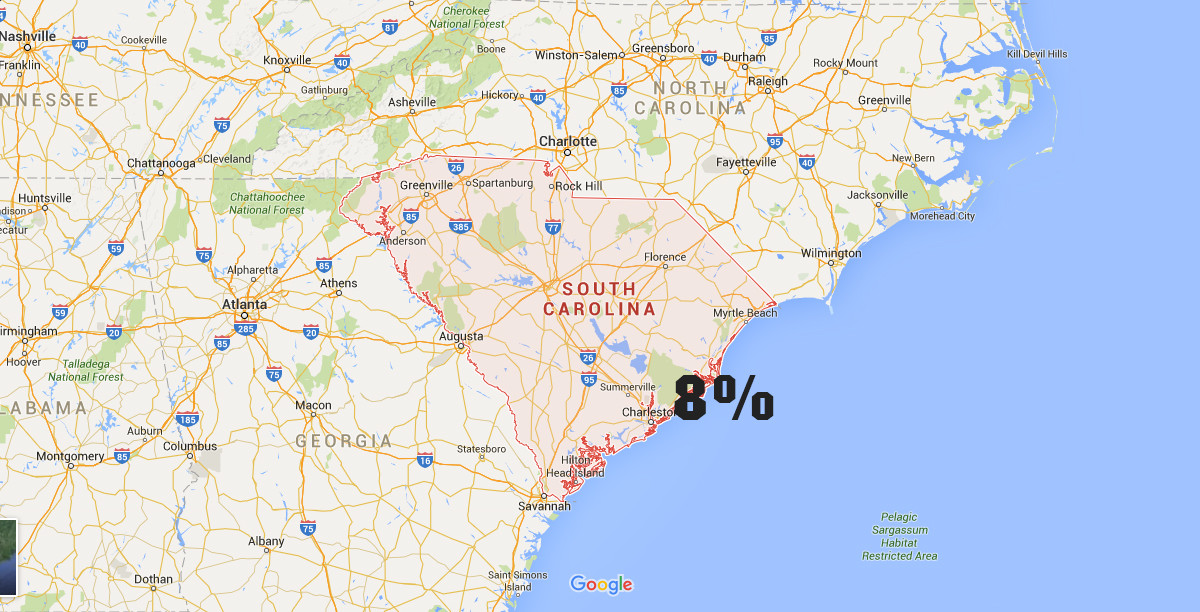

South Carolina Tax Liens

Interest rate in South Carolina is between 8% and 12% and is dependent on the sale procedures used. The redemption period may also vary from 1 year to 18 months. Tax lien sales are held in October and November and is done through competitive bidding. However, one must pay by the end of the day or he may be fined to a maximum of $300.

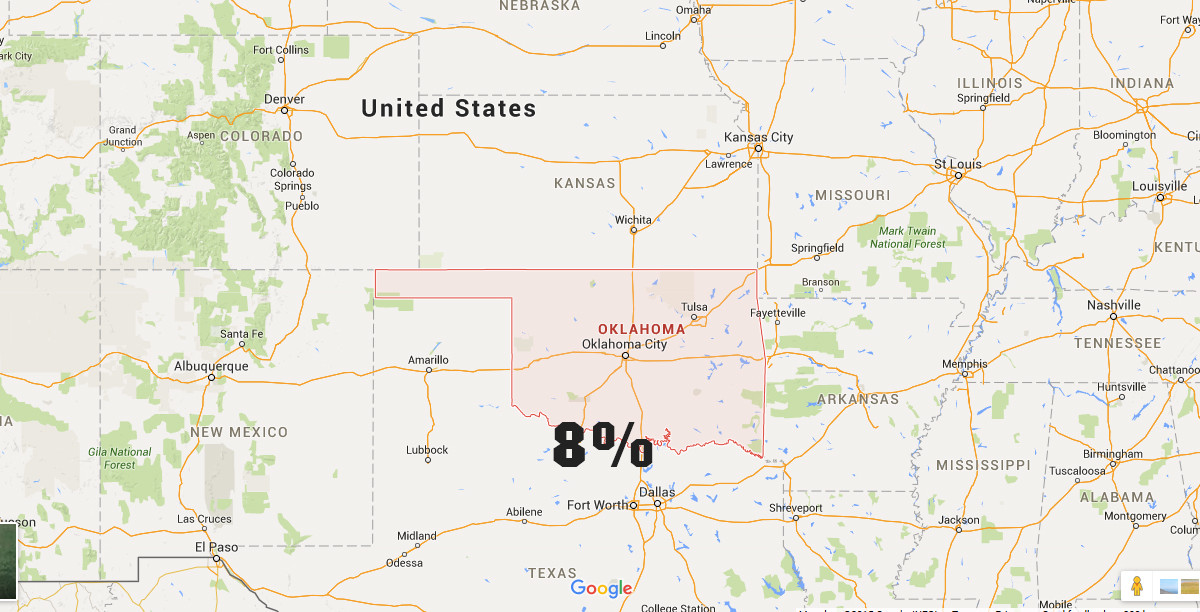

Oklahoma Tax Liens

Oklahoma sells both tax lien and deed certificates. It has a redemption period of two years with an interest rate of 8%. Just like most states, sales are done through competitive bidding.

New Jersey Tax Liens

ew Jersey’s tax lien auction schedules actually vary, depending much on each municipality. The redemption period is 2 years and its interest rate is 18% or more, dependent on the penalties. It also follows competitive bidding and will start by having the participant bid the interest rate down.