Local governments would go bankrupt if they were not able to collect delinquent property taxes. When you buy tax lien certificates you’re helping local communities recover lost tax revenue so they can pay for essential services such as teachers, fireman, and emergency services.

Tax Lien Certificates Can Fit Nearly Any Budget

The government sells tax lien certificates on all types of real estate including multi-million dollar penthouse suites to vacant vacation lots. Because property taxes account for a small fraction of the value of the property (less than 2%), you can find tax lien certificates that will fit most budgets.

Pros and Cons of Tax Lien Investing

By now, TAX LIEN SEMINARS, presumes that almost everybody has a good understanding of tax lien investment, considering the number of articles we have had published about it. We know that the potential returns are enormous, and so are the risks. Any way, for new potential investors, we are giving yet, a few backgrounders on tax lien investing in the simplest language for everybody to understand:

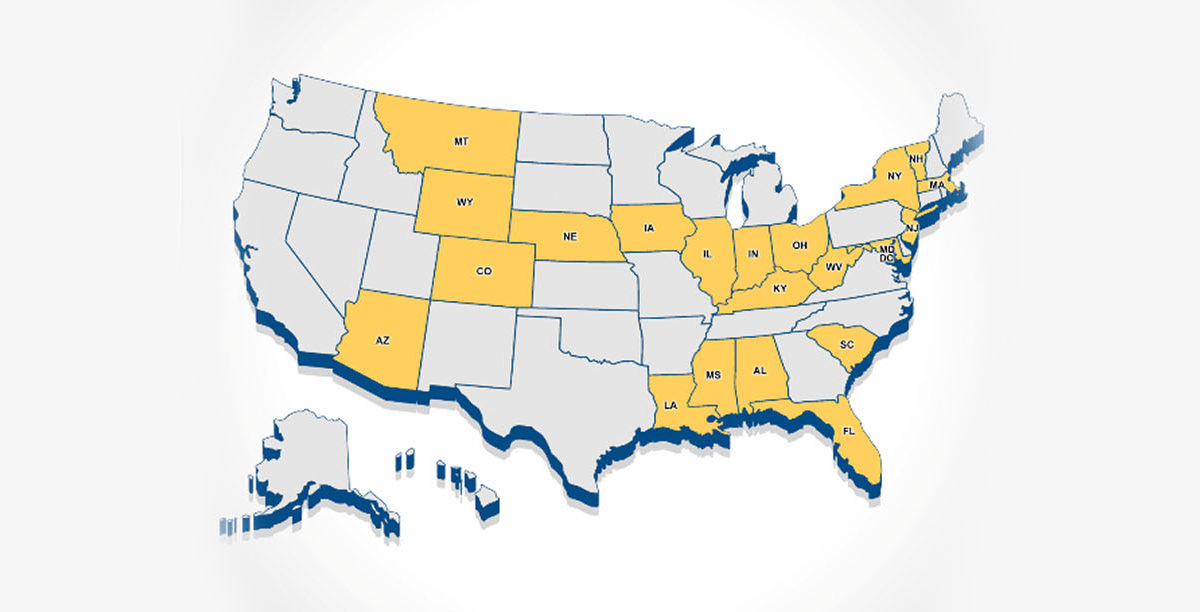

Not all States Offer Tax Lien Certificates

Currently, tax lien certificates are offered in about half the states in the United States, the remaining half offer what are known as tax deeds. Both tax lien certificates and tax deeds are a way for local governments to recover lost property tax revenue to fund public school, police departments, fire departments, libraries. and public roads. For educated investors, both can offer a very profitable investment opportunity.

Tax Attorney Help Ease Your Debt Problem

If you are in trouble with the IRS, then it is time to hire the services of a tax attorney to help ease your tax debt problem. If you do not do this in the earliest time possible, your property might face foreclosure and be sold through an auction. Winning bidders get the tax lien certificates of properties won via sale.

What are IRS Real Estate Auctions

In our previous articles, we had discussed and understood the mechanics of Tax Lien on real estates, which basically, involves two types. The tax lien certificates where a bidder/buyer bought the unpaid or delinquent taxes of a foreclosed property as investment. The other is the Tax Deed Sale where the winning bidder or buyer practically, bought and paid for the property itself by paying the delinquent taxes plus some penalties and value on the property imposed by the taxing authority. Basically, a bigger sum of money is needed in a Tax Deed sale.

What are the Common Risks in Investing in Tax Liens and Tax Deeds?

As a great American statesman and inventor once said, “ nothing in this world is certain but death and taxes”. Of course, everything will come to pass, and so does any business or career that we may engage in. Even what seems to look like a surefire investment can sometimes, turn topsy-turvy.

Tax Lien Imposition to Delinquent Homeowners

There are so many properties in the U.S. that it is difficult to track all. Though, government agencies do this as part of their job. Nonetheless, a lot of those can possibly match the number of tax delinquent homeowners.

Learning Tax Lien Investing System.

Learning the system of tax lien investing is indeed important because it can result to a successful investment and a worthwhile time for you. Counties may have similarities in their systems when conducting tax lien auctions, but the common denominator is the profit earned. Research ahead of time for the frequency of the sale, and the number of bidders allowed per sale.

Tax Lien Auctions as Passive Income

You need to put in some hard work first, prior to creating a passive income in real estate. This is especially true for tax lien investing which can give you the opportunity to sit back and relax while earning profits. However, as much as tax lien investing is so enticing, and can give you passive income do not invest if you have not done some due diligence first.