Ohio is actually a good state for buying tax lien certificates but these sales are limited to the institutional investors which are able to afford large tax lien packages.

North Dakota Tax Deeds

North Dakota only has tax deed sales and these sales are in November. All the tax sale auctions are by competitive bidding.

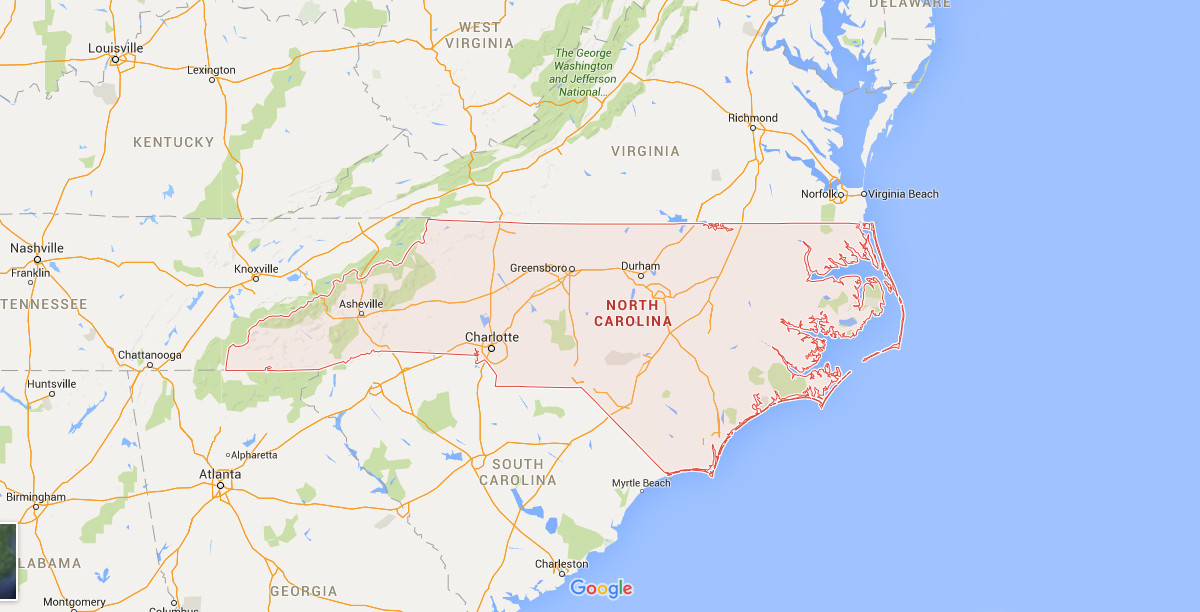

North Carolina Tax Deeds

Tax deed sales are in December in North Carolina. This state holds formalized tax deed or tax foreclosure sales almost 4 times a year. In a 10 day upset period, a bidder can cause a resale through bidding greater than 5% or $750 for the resale to take place.

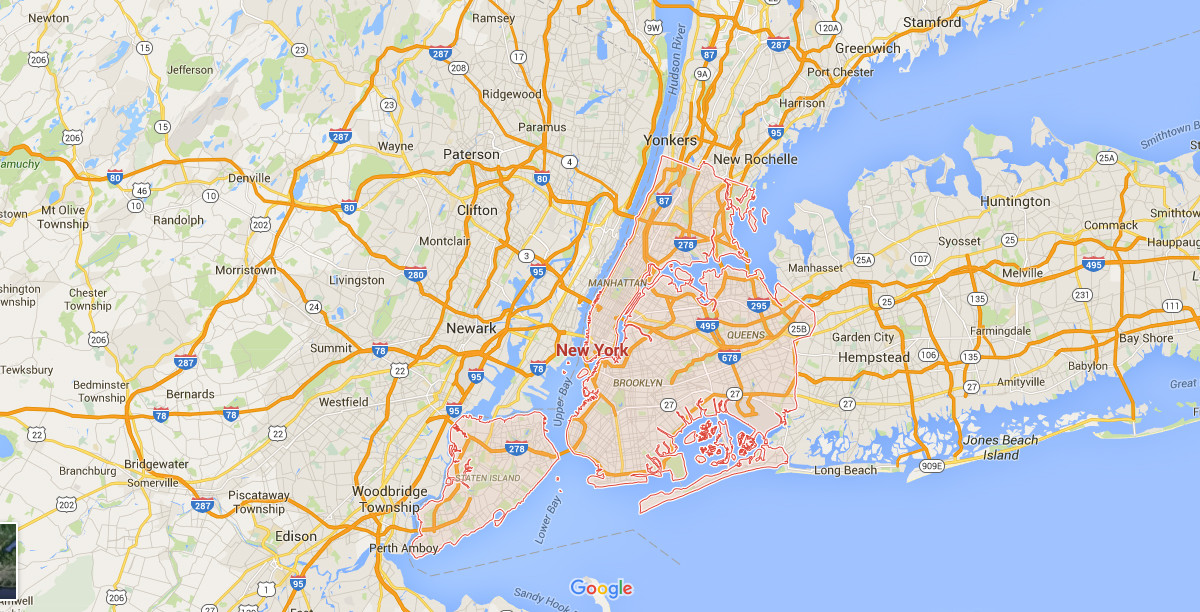

New York Tax Deeds

New York is both a tax lien and tax deed state. This state may be average when it comes to tax lien sales but with tax deeds, it is definitely one of the most popular.

New Mexico Tax Deeds

New Mexico is a straight tax deed state. Its redemption period may vary but usually 2 years is the time when the previous owner will have the right to challenge the ruling in the court.

New Hampshire Tax Deeds

New Hampshire does not conduct tax lien sales but property owners are required to pay the county 18% interest for the tax lien to be erased or they may lose the property to foreclosure.

Nevada Tax Deeds

Nevada is a mixed tax state because it conducts tax deed and tax lien sales. The interest rate is 12% but most of the counties only handle tax deed sales. The redemption period is 120 days for a vacant land while a developed land is 2 years. The tax auctions vary on each county.

Minnesota Tax Deeds

Minnesota only conducts tax deed sales. It has a redemption period of 1 year. The tax deed sales are in April, May, September, and October and are by competitive bidding.

Michigan Tax Deeds

Michigan used to be a good state for tax liens until it stopped handling tax lien certificates. However, Michigan continues to conduct tax deed sales. The redemption period is 2 years.

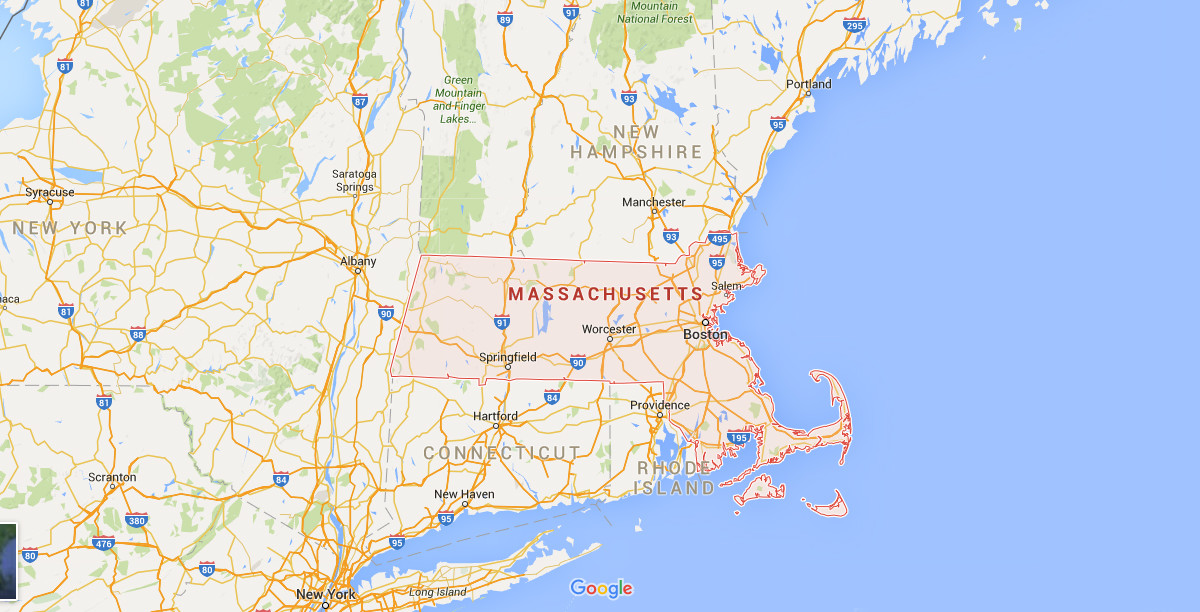

Massachusetts Tax Deeds

Massachusetts can have both tax lien and tax deed certificate sale but most municipalities have tax deed certificate sales. It has a 16% interest rate but there is no right of redemption after a tax deed sale. The tax sale processes and rules may vary according to different municipalities but all auctions are done through competitive bidding.