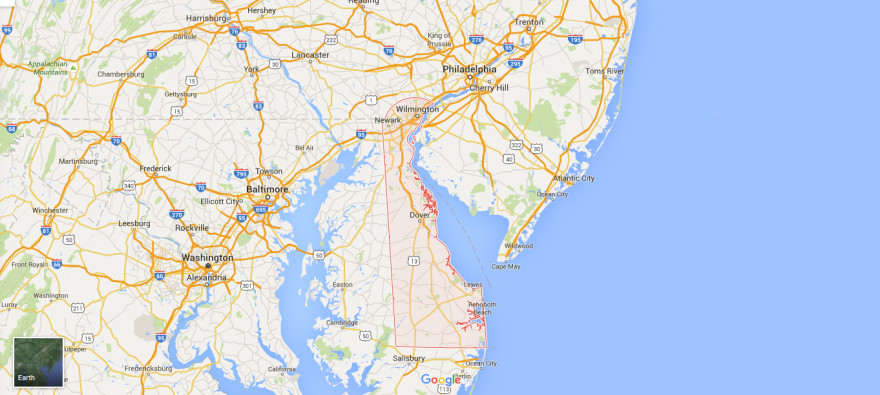

This state has no tax liens. But there are some counties which offer rights of redemption. If the tax has been redeemed, the investor will receive 15 to 20%, dependent on the county’s rules.

The specific county’s rules determines the redemption period. As mentioned earlier, Delaware’s counties conduct tax deed sales done by competitive bidding.