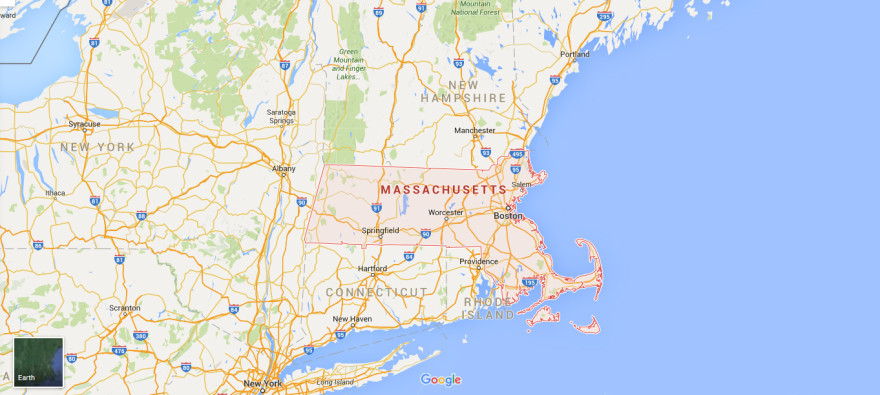

Massachusetts can have both tax lien and tax deed certificate sale but most municipalities have tax deed certificate sales. It has a 16% interest rate but there is no right of redemption after a tax deed sale. The tax sale processes and rules may vary according to different municipalities but all auctions are done through competitive bidding.

Our Blog

![]()

Stay in touch with us:

- Housing Market Academy LLC

- +1.813.579.5400

- [email protected]

- 3001 Rocky Point Drive East, Tampa, FL 33607

Recent Posts

-

Why You Need to File a Tax Extension August 16, 2018

Why You Need to File a Tax Extension August 16, 2018 -

Tax Saving Tips During Your Kids Summer Vacations August 14, 2018

Tax Saving Tips During Your Kids Summer Vacations August 14, 2018 -