This state has no tax liens. But there are some counties which offer rights of redemption. If the tax has been redeemed, the investor will receive 15 to 20%, dependent on the county’s rules.

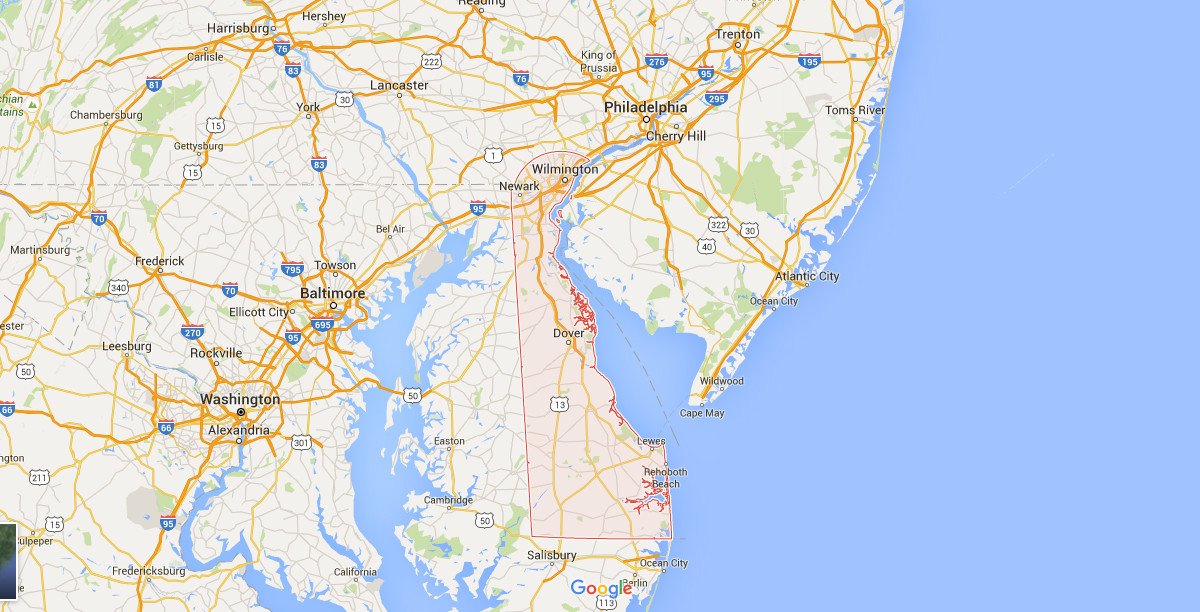

Delaware

![]()

Stay in touch with us:

- Housing Market Academy LLC

- +1.813.579.5400

- [email protected]

- 3001 Rocky Point Drive East, Tampa, FL 33607

Recent Posts

-

Why You Need to File a Tax Extension August 16, 2018

Why You Need to File a Tax Extension August 16, 2018 -

Tax Saving Tips During Your Kids Summer Vacations August 14, 2018

Tax Saving Tips During Your Kids Summer Vacations August 14, 2018 -