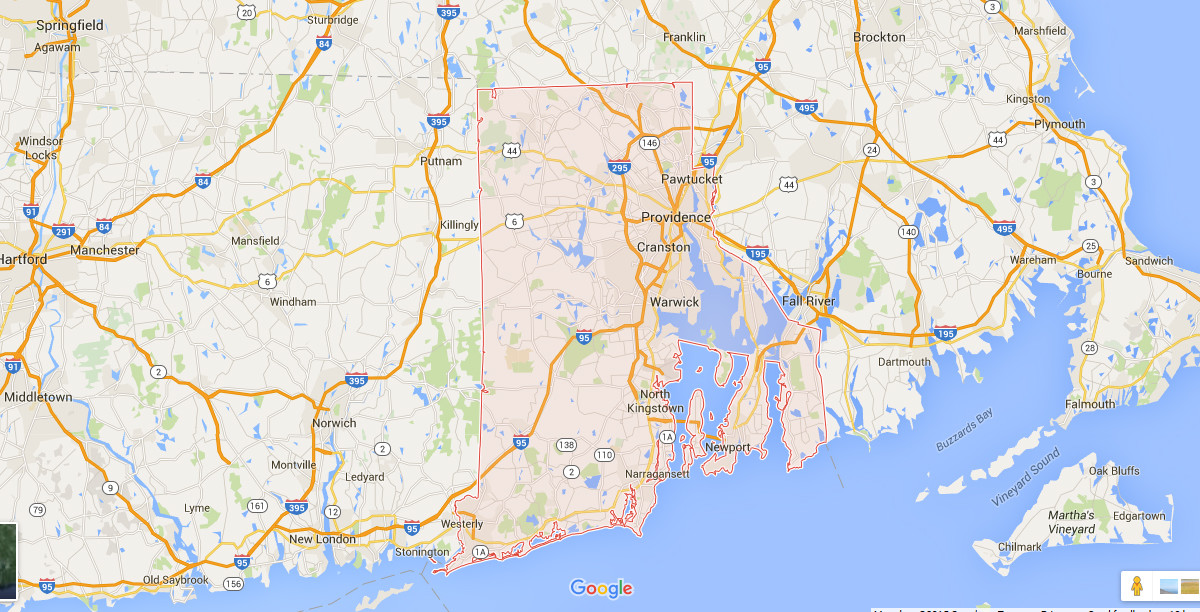

Though Rhode Island does not conduct tax lien sales, it holds tax deed certificate sales with 16% interest rate right of redemption. The auctions are done by competitive bidding and buyers may bid partial ownership.

Pennsylvania Tax Deeds

Pennsylvania only conducts tax deed certificate sales. In most counties, there will be no right of redemption after the sales except for Philadelphia wherein it may apply if the property was occupied by the owner 90 days before the sale. Most sales occur in September while the Judicial Sales occur in spring.

Oregon Tax Deeds

Oregon only has tax deed sales wherein there is no redemption period or no interest rate. The tax deed certificate sale schedules vary. These sales are usually done by competitive bidding and its minimum bid is set at 80% of its assessed value.

Oklahoma Tax Deeds

Oklahoma only conducts tax deed sales which are usually offered in the month of June. The minimum begins at the taxes that are being owed.

Ohio Tax Deeds

Ohio is actually a good state for buying tax lien certificates but these sales are limited to the institutional investors which are able to afford large tax lien packages.

North Dakota Tax Deeds

North Dakota only has tax deed sales and these sales are in November. All the tax sale auctions are by competitive bidding.

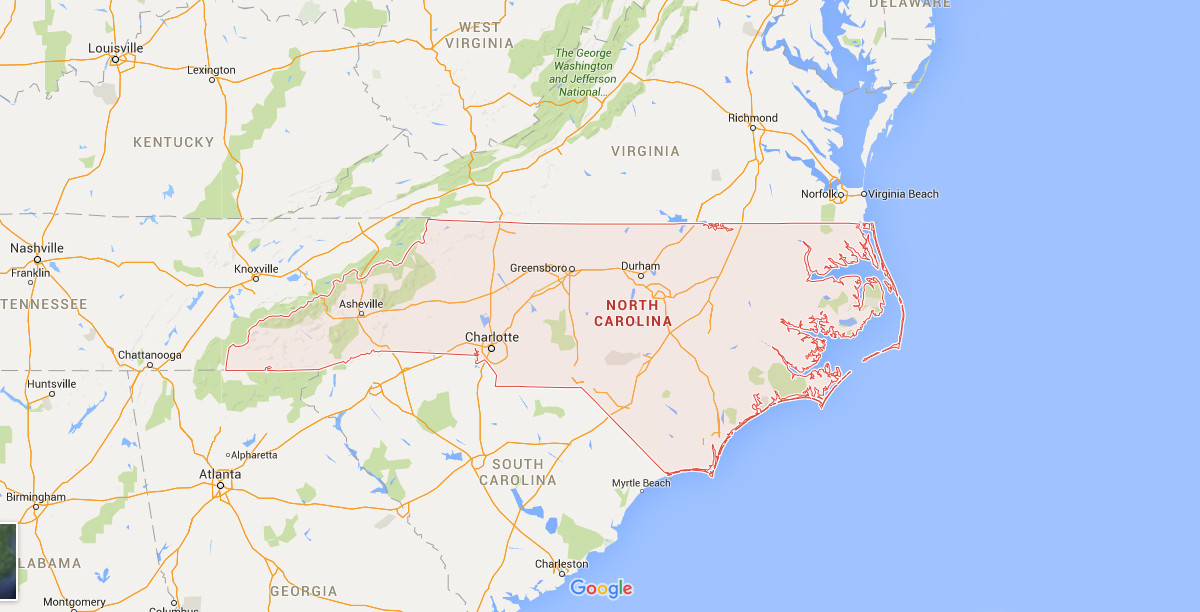

North Carolina Tax Deeds

Tax deed sales are in December in North Carolina. This state holds formalized tax deed or tax foreclosure sales almost 4 times a year. In a 10 day upset period, a bidder can cause a resale through bidding greater than 5% or $750 for the resale to take place.

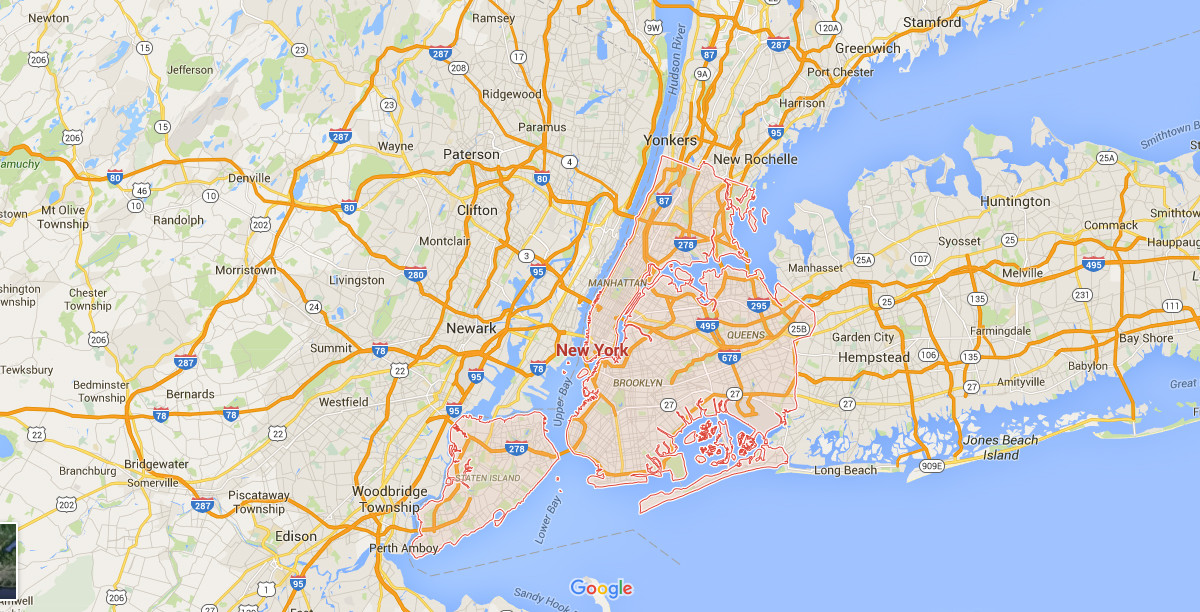

New York Tax Deeds

New York is both a tax lien and tax deed state. This state may be average when it comes to tax lien sales but with tax deeds, it is definitely one of the most popular.

New Mexico Tax Deeds

New Mexico is a straight tax deed state. Its redemption period may vary but usually 2 years is the time when the previous owner will have the right to challenge the ruling in the court.

New Hampshire Tax Deeds

New Hampshire does not conduct tax lien sales but property owners are required to pay the county 18% interest for the tax lien to be erased or they may lose the property to foreclosure.