Nevada is a mixed tax state because it conducts tax deed and tax lien sales. The interest rate is 12% but most of the counties only handle tax deed sales. The redemption period is 120 days for a vacant land while a developed land is 2 years. The tax auctions vary on each county.

Minnesota Tax Deeds

Minnesota only conducts tax deed sales. It has a redemption period of 1 year. The tax deed sales are in April, May, September, and October and are by competitive bidding.

Michigan Tax Deeds

Michigan used to be a good state for tax liens until it stopped handling tax lien certificates. However, Michigan continues to conduct tax deed sales. The redemption period is 2 years.

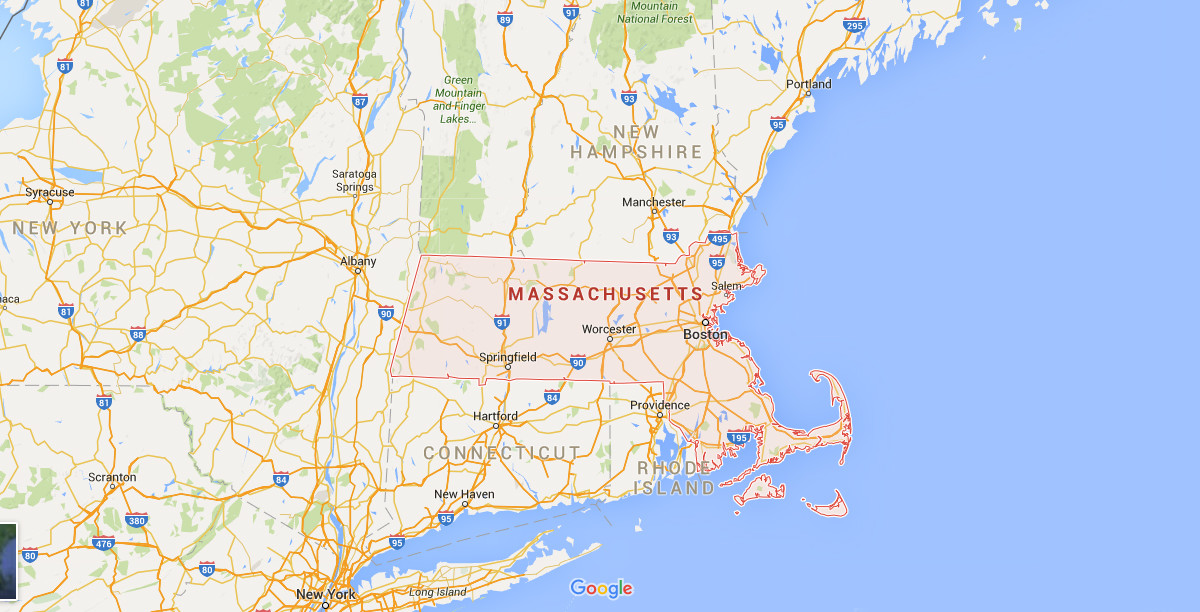

Massachusetts Tax Deeds

Massachusetts can have both tax lien and tax deed certificate sale but most municipalities have tax deed certificate sales. It has a 16% interest rate but there is no right of redemption after a tax deed sale. The tax sale processes and rules may vary according to different municipalities but all auctions are done through competitive bidding.

Maine Tax Deeds

There is no interest rate in Maine as it only conducts tax deed certificate sales. The redemption period varies according to each municipality or county. The process and rules varies as well.

Kansas Tax Deeds

Kansas is a tax deed only state so it does not have any interest rate. The redemption period varies, handled by each of the counties. The sheriffs handle the sales with the counties’ cooperation. These counties have different rules and processes and they don’t have consistent sale schedules.

Idaho Tax Deeds

Since Idaho is a tax deed state, it does not have an interest rate for tax liens. Counties get their deed to the property and have it sold it investors after 3 years of unpaid taxes. Usually, counties don’t have specific sale schedules as they conduct the sales when buyers show interest in the properties. Some of Idaho’s counties have their tax deed sales online.

Hawaii Tax Deeds

Hawaii only has tax deed sales and no tax lien certificate sales. If the deed is redeemed, there will be a 1 year right of redemption that will pay 12%. Note that each county in Hawaii has different rules, processes, and even redemption periods.

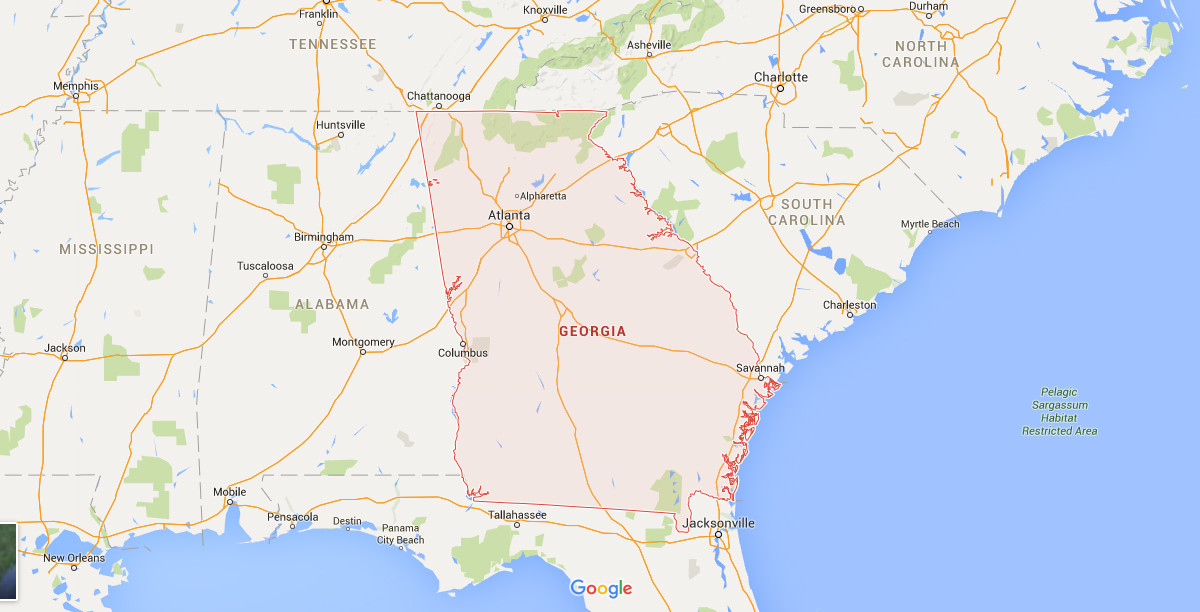

Georgia Tax Deeds

Georgia holds a lot of tax deed sales but the processes may be more complicated than other states. This state does not conduct tax lien sales.

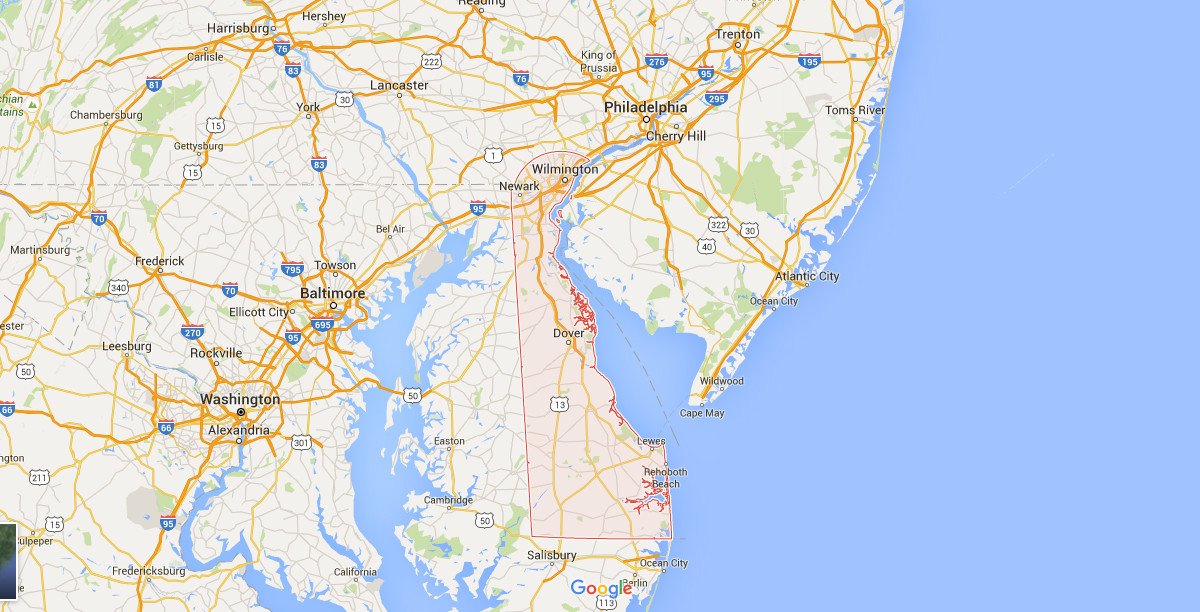

Delaware Tax Deeds

This state has no tax liens. But there are some counties which offer rights of redemption. If the tax has been redeemed, the investor will receive 15 to 20%, dependent on the county’s rules.