3 Essential Differences Between Tax Liens and Deeds (Tax Liens 101)

If you’re still a little bit confused on Tax Liens and Tax Deeds, and how they can benefit you (And are actually different things altogether), I totally get that, and you’re in the right spot to learn more.

Live From the Trenches

Today, I am going to show you a video live from the trenches of hunting for Tax Deed properties. You are going to see just how easy it is to do this.

Does It NOT Hurt Enough For Change?

Has there ever been something that you wanted, but you didn’t want it bad enough to actually do something about it?

I know there is many times that I see a pretty fancy car driving down the street, (and I’m talking really fancy…)

West Virginia Tax Liens

he interest rate in West Virginia is 12% but there will be no interest received on an overbid. The redemption period is 17 months. Tax lien certificate sales are in October and November in some counties and follow competitive bidding.

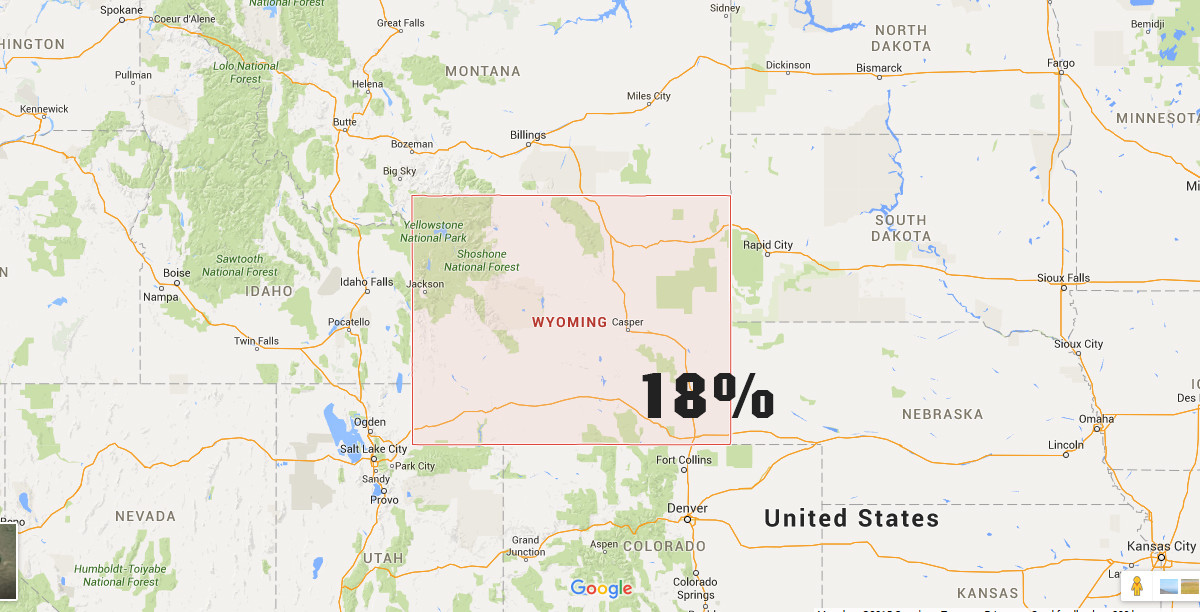

Wyoming Tax Liens

In Wyoming, the redemption period is 4 years with an 18% interest rate. Most tax lien certificate sales in majority of its counties are held in July through October. The tax lien auctions are done through competitive bidding.

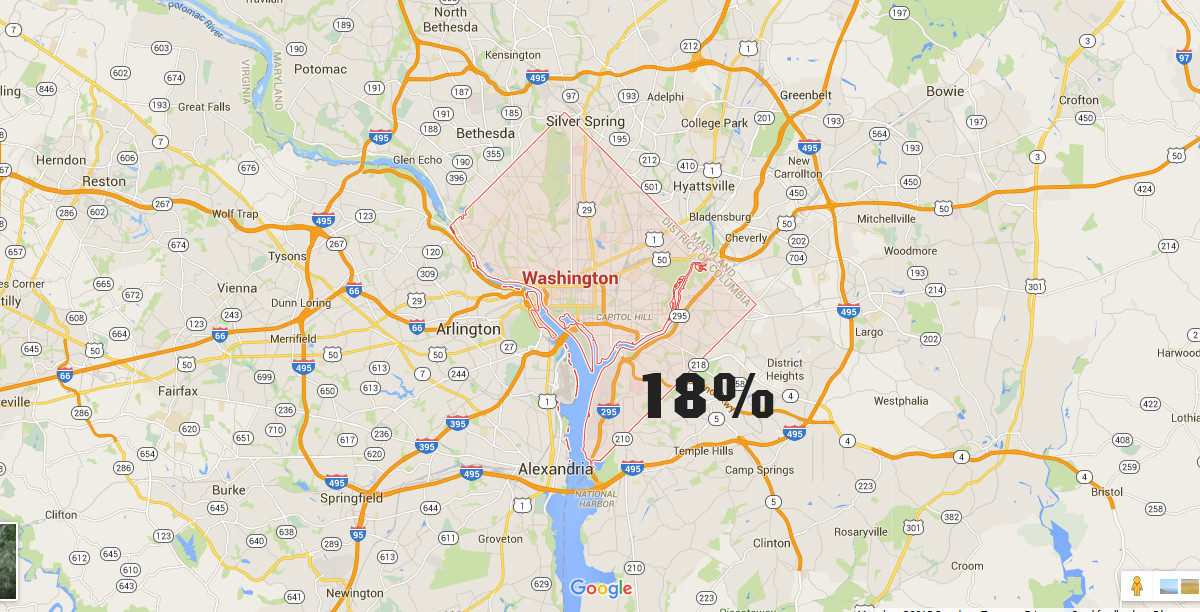

Washington DC Tax Liens

Both handling tax lien and tax deed sales, Washington DC has an 18% interest rate per year (1½ % per month) with a redemption period of 6 months. All tax lien sales are by competitive bidding but with no interest on an overbid.

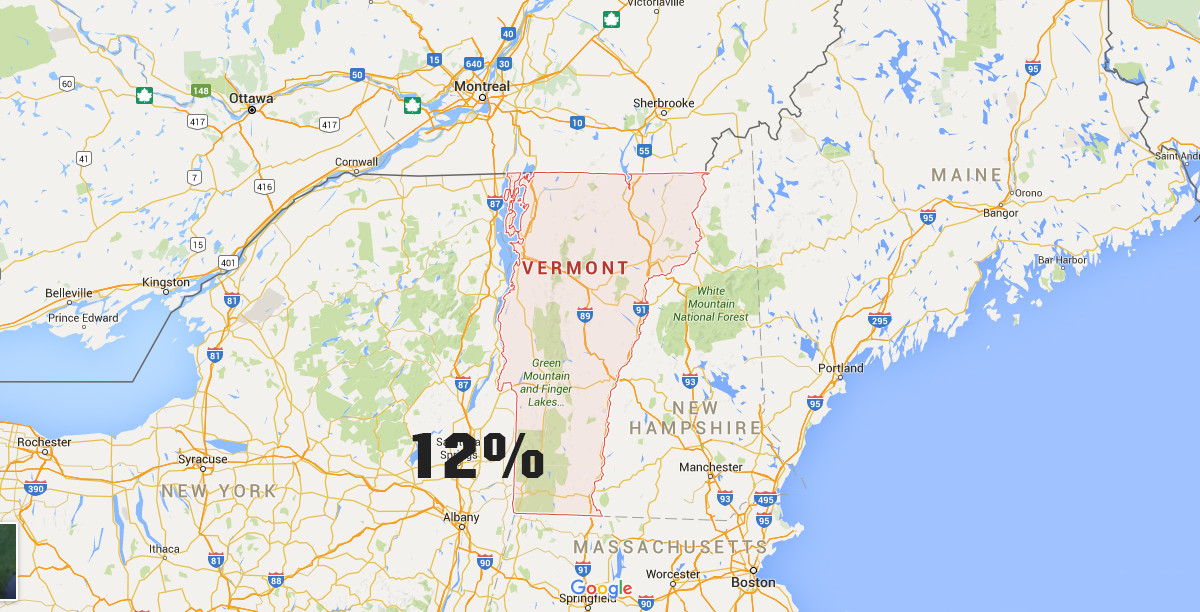

Vermont Tax Liens

Vermont has an interest rate of 12% and a redemption period of 1 year. All of its tax lien certificate auctions are done by competitive bidding.

South Dakota Tax Liens

As of 2006, South Dakota does not conduct Tax Lien or Tax Deed Auctions. However, foreclosure sales are held at state level.

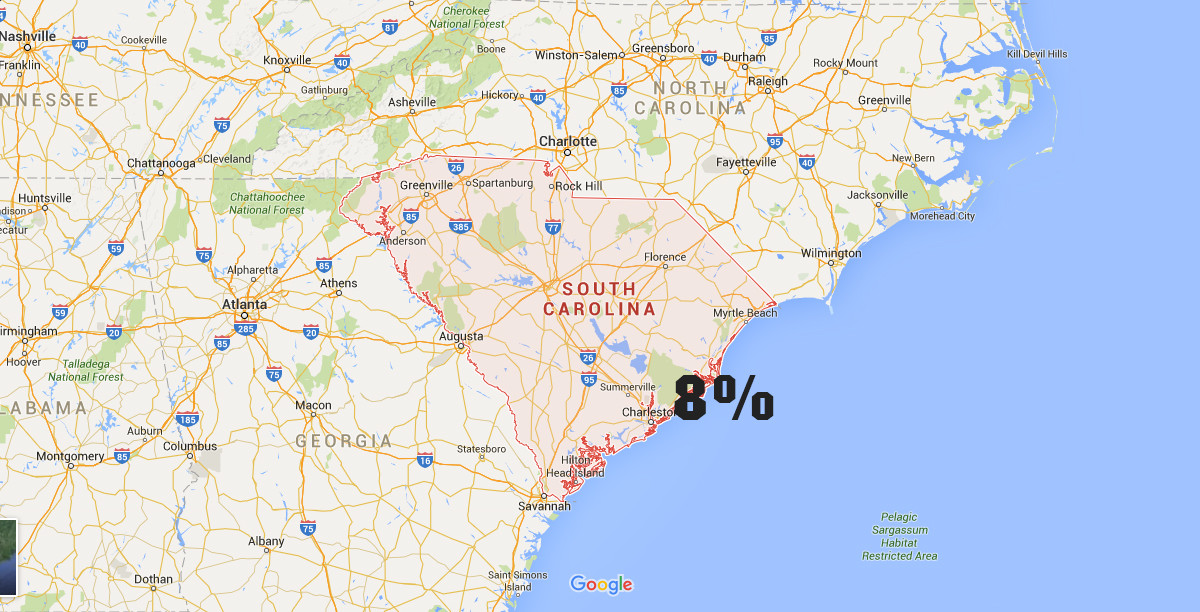

South Carolina Tax Liens

Interest rate in South Carolina is between 8% and 12% and is dependent on the sale procedures used. The redemption period may also vary from 1 year to 18 months. Tax lien sales are held in October and November and is done through competitive bidding. However, one must pay by the end of the day or he may be fined to a maximum of $300.