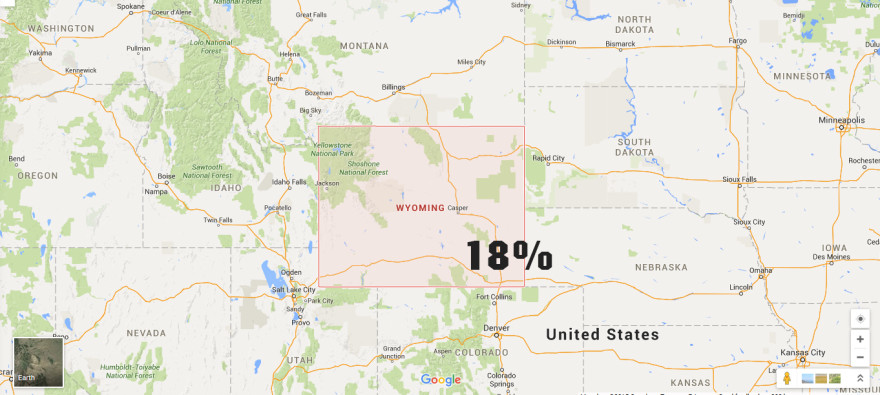

In Wyoming, the redemption period is 4 years with an 18% interest rate. Most tax lien certificate sales in majority of its counties are held in July through October. The tax lien auctions are done through competitive bidding.

Our Blog

![]()

Stay in touch with us:

- Housing Market Academy LLC

- +1.813.579.5400

- [email protected]

- 3001 Rocky Point Drive East, Tampa, FL 33607

Recent Posts

-

Why You Need to File a Tax Extension August 16, 2018

Why You Need to File a Tax Extension August 16, 2018 -

Tax Saving Tips During Your Kids Summer Vacations August 14, 2018

Tax Saving Tips During Your Kids Summer Vacations August 14, 2018 -